Tax Year 2024

The 2024 filing season start date January 27, 2025

Due April 15, 2025

Welcome and thank you for visiting Penrod Tax Service, Inc. We are a locally owned tax, bookkeeping, and payroll company, and have been in the Michiana area for over 29 years. Our full time staff is friendly, knowledgeable, and has over 100 years of combined experience.

Please, feel free to browse our website to see the services we offer as well as the many helpful resources we provide. When you are ready to learn more about what we can do for you, we encourage you to contact us.

Refund Delays

Please be aware that the Path Act requires IRS to hold refunds on returns that contain the Earned Income Credit or the Refundable Child Tax Credit until Mid February. According to IRS, these refunds might not be deposited until the first week of March.

Tax “Adjacent” Quick Links

On Sunday, March 2, the Treasury Department announced that it will not enforce the reporting rule against domestic reporting companies and plans to issue proposed regulations to revise it so that only foreign reporting companies must file a BOI report. Treasury also reiterated that it will not impose penalties under the existing regulatory deadlines until the new reporting rule takes effect.

- Information from the Auditor’s page

- Online Application for the Over 55 County Option Circuit Breaker Tax Credit

- Fill-in Form St Joseph County 55 and Older Circuit Breaker Credit

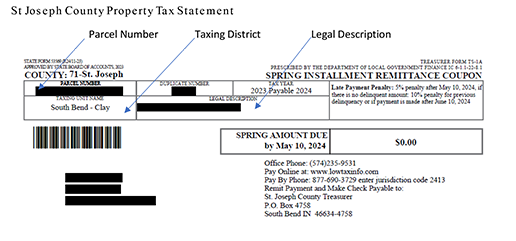

Sample Tax Form